Can Expats Afford to Buy Property in London?

[vc_row][vc_column][vc_column_text]The nation’s capital is more appealing to people than ever before. With a vibrant and lively way of life mixed with fantastic career opportunities, London is an attractive city for expats to live in. However, property prices within London are extremely expensive in comparison with the rest of the country and much of Europe. With this in mind the big question on the minds of expats wanting to live in the capital is often, ‘can I afford this?’

Why do expats want to live in London?

When it comes to offering opportunities, there is no better place than London. Whether it is career prospects or social aspects of life, London has it all. So, what does it exactly have to offer?

According to an Expat Explorer survey, when it comes to offering expats fantastic opportunities, London is ranked 2nd in the world behind San Francisco. With 75% of people surveyed stating that London is the ideal place for career progression in the UK, coupled with an average wage of £38,335 a year – you can understand why so many young professionals make the move from overseas.

Away from the working world, London’s iconic landmarks and multiculturalism mean the city is often ranked above New York and Dubai in polls. London truly is a special city.

London’s Property Market

The effect of Brexit on London’s property market

The 2019 property market has thrown up some surprises. With the uncertainty of Brexit looming over, the market has reacted negatively with a fall in the average price of properties. Many sellers in the capital are finding it a struggle to sell houses fast or in a time frame that suits them, which could equal good news for expats ready and raring to be London homeowners.

The February 2019 seasonal report produced by the Office for National Statistics, reported a 3.8% fall in the average house price within London from February 2018 to £462,000. The uncertainty caused by Brexit affected some London Boroughs worse than others, with prices around Central London witnessing a steeper fall (January 2018 – January 2019):

- The Borough of Westminster: fall of 14.03%

- The Borough of Camden: Fall of 8.25%

Although this isn’t the best sign for the market, it is important to remember how expensive London is in comparison to the rest of the country. With the average house price in February 2019 £145,000 more expensive than the South East of England, which has the second most expensive property prices.

Buying vs renting in London

No matter where you are thinking of purchasing property, several questions must be answered. One of the most important is understanding whether it is more affordable to rent or buy. With property prices and rents on the rise, this question is becoming more crucial in today’s market – especially within London.

Although property prices and average rents are constantly changing, making it slightly more difficult to give a direct answer to this question. It was reported in January of 2019, with the demand for properties to let in the last quarter of 2018 (22% decrease in properties available), this caused the average rent price to rise by 2.1% to a high of £2,034. Further reports suggest that this could rise to 4% by the end of 2019.

In a similar trend to rent prices, the average deposit needed for a property have risen substantially. According to Zoopla, the average deposit for a first property hit £126,00 (around 27% of the asking price), with the highest percentage requiring potential buyers paying 30% – £194,373 in Camden. Even with the higher average wages in London, the ability to borrow more than 70% of the asking price is an intimidating factor for many.

What are London property prices looking like today?

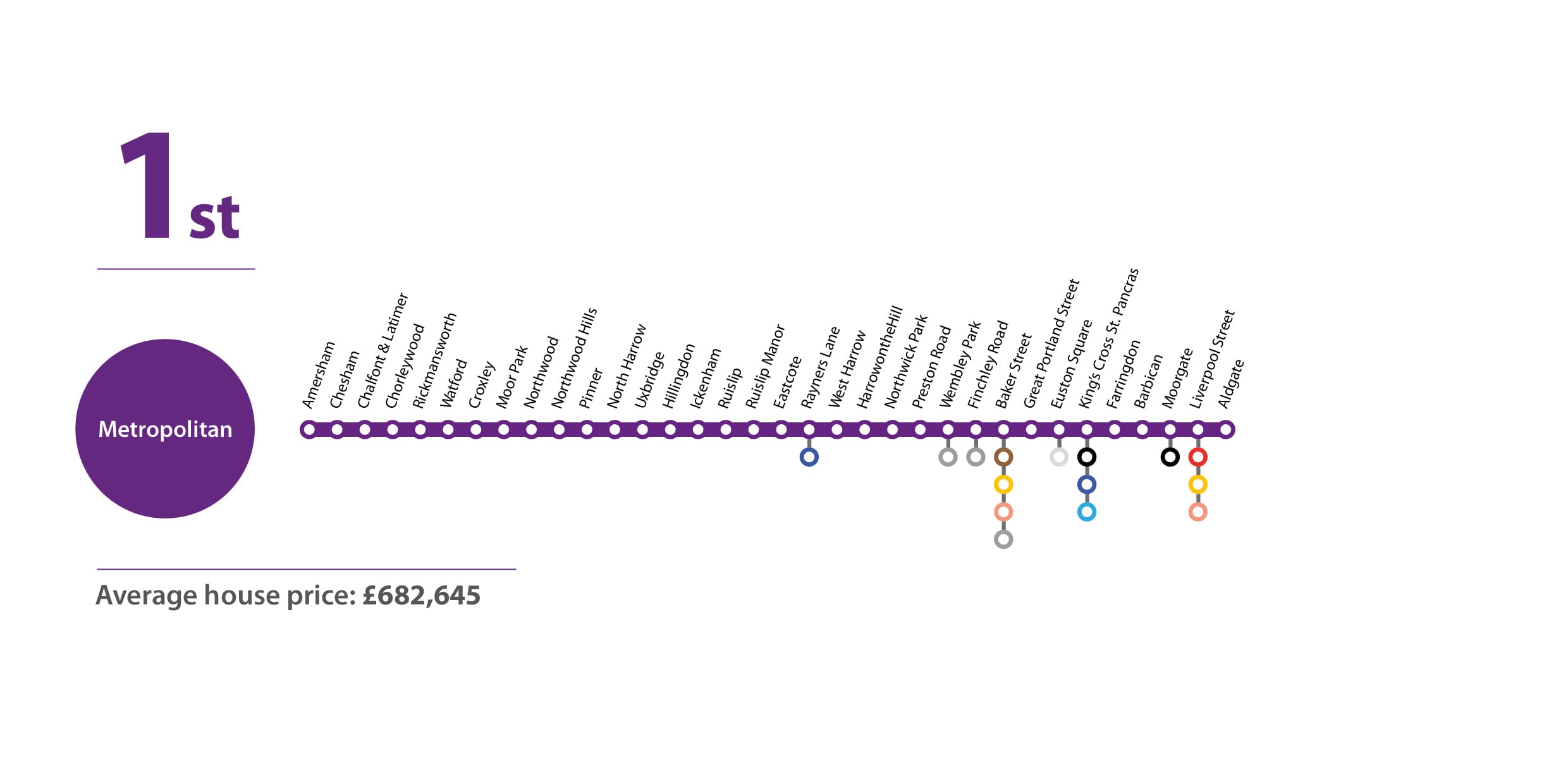

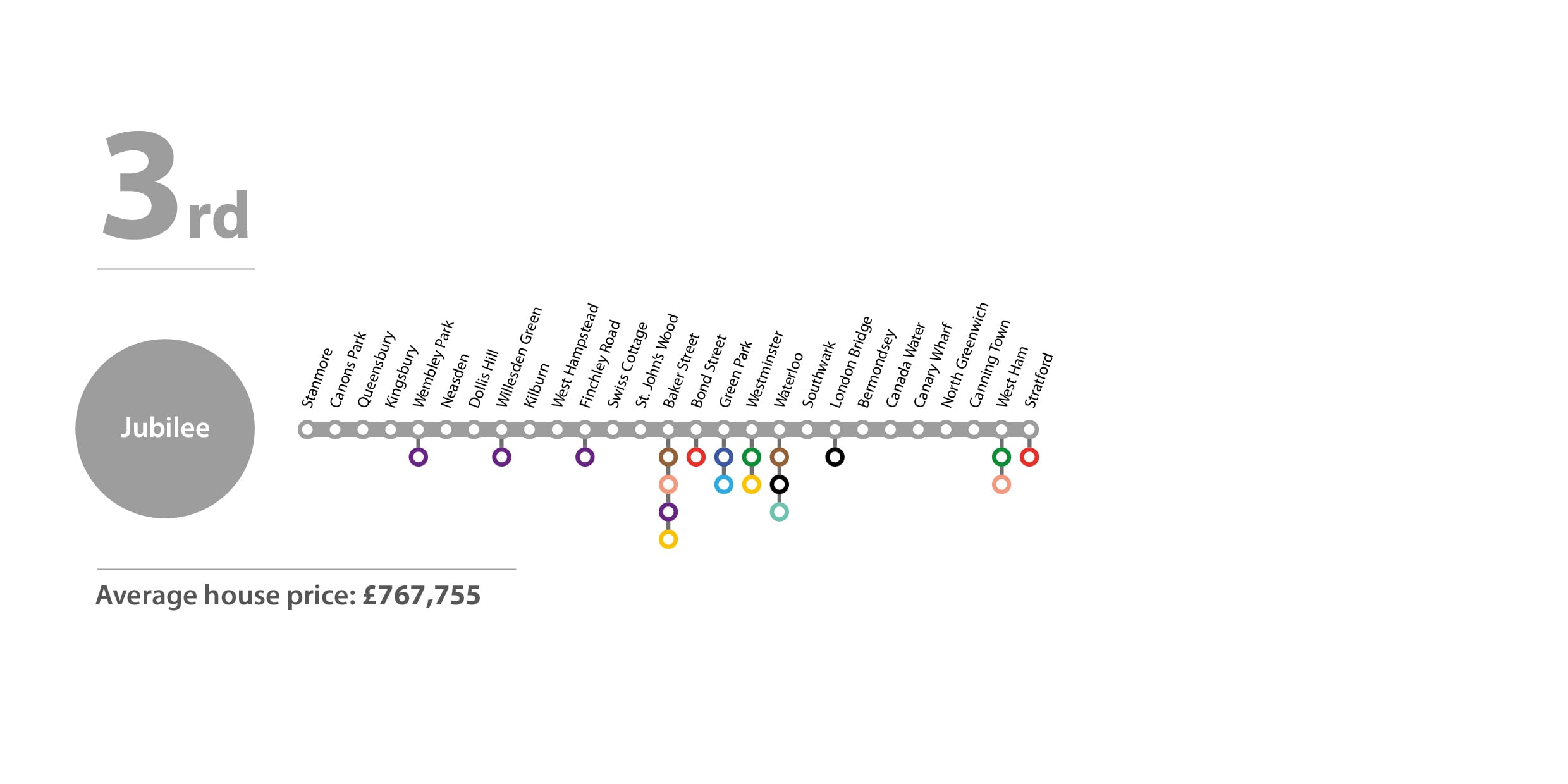

Sold.co.uk recently published their interactive map of London house prices, using the London Underground system to show the differences in prices across the city. Through comparing prices between 2016-19, it is clear to see that all London Underground lines have seen increases in property prices, with the Central and Jubilee line witnessing the largest increases.

Below are the 3 most affordable tube lines to buy properties on:

Graphics provided by Sold.co.uk

London of all places is not usually somewhere you would class as affordable. However, with the uncertainty in prices, 2019 is a promising and one of the most affordable years for those looking to make a move into London’s property market.[/vc_column_text][/vc_column][/vc_row]